Bitcoin ETFs: what it means for crypto as an asset class

Early 2024 marked a decisive turning point for Bitcoin and the crypto industry, with the SEC's approval of the first Bitcoin ETFs. This decision, which seemed inevitable after the SEC lost a significant lawsuit to Grayscale, signals the start of a new era for widespread adoption of the asset.

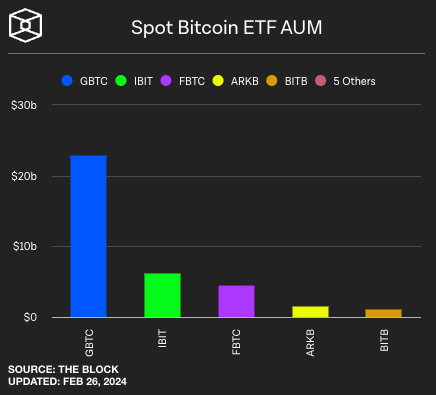

With a historic performance from launch, recording nearly $40 billion in assets under management (AUM) in just five weeks, these ETFs not only broke all launch records, but also confirmed investors' growing appetite for digital assets. Blackrock's iShares Bitcoin Trust (IBIT), for example, attracted $5 billion in bitcoins on its own. The majority of these ETFs' assets under management are in the Grayscale BTC Trust (GBTC) ETF, which existed as a different product before being converted into an ETF. It still holds the most assets, although it has lost $7 billion in bitcoins due to the closure of previous arbitrage operations by traders and the adoption by investors of other ETFs with lower fees.

For the first time, these ETFs offer the possibility of investing in bitcoin without having to store it in one’s own crypto wallet and manage the associated security risks. What impact will the approval of Bitcoin ETFs have on the future of the crypto market?

The impact on adoption

The introduction of Bitcoin ETFs greatly simplifies access to cryptos for a wide range of investors, particularly those previously reluctant to use wallets and even exchanges that were often unregulated. These investment products offer a secure, regulated, cost efficient gateway to the crypto market, integrating within the over $4.5 trillion ETFs market in the US. Investors will now be able to enjoy access to these assets on their usual investment platforms, avoiding the constraints associated with previous investment products such as Grayscale Trust or futures ETFs.

The distribution of Bitcoin ETFs through major US financial entities such as Blackrock, Fidelity, and Ark, among others, promises increased and diversified adoption. This adoption is all the more significant as it introduces cryptos as a viable savings product in the eyes of a wider audience. Nevertheless, their distribution is not yet universal, offering further growth potential as these products are integrated into other wealth management and IRA platforms, attracting new investment flows.

Opening up the crypto market to financial institutions

ETFs, designed primarily for individual investors, remain products managed and distributed by the largest financial institutions. Indeed, ETF managers and market makers include the likes of Blackrock, Fidelity, JP Morgan and Jane Street. The involvement of major financial players further validates and legitimizes cryptos in the financial industry and with regulators.

This step also marks a technical novelty for financial institutions that manage these ETFs and buy and keep the bitcoins, who will have to familiarize themselves with blockchain technologies new to them, such as cryptocurrency custody. In addition, companies specializing in crypto, such as Coinbase, the preferred place in the USA for institutions to trade cryptos, will continue to grow in importance by welcoming these institution on their platform, becoming a key player for institutions wishing to enter the field.

Future prospects for the industry

The existence of ETFs as a means of investing in Bitcoin reveals very strong long-term growth potential, and the beginning of a new era.

The question of extending ETFs approval to other crypto assets in the short term, such as an ETH ETF, raises questions. On the one hand, the regulatory precedent set by the introduction of the Bitcoin ETF offers a well-defined framework for the introduction of a similar product on ETH, however, specific challenges such as the existence of staking could potentially make ETH a security, and shift the balance for the SEC. In the more distant future, however, we can imagine ETH and many other cryptos such as SOL trading in these products.